BLUESTONE MERCHANT FUND LTD

The Investment case

Currently commercial banks have significantly reduced their appetite in trade finance. This is especially true for small and medium sized trading houses.

In the current low interest rate environment, investors want to diversify their portfolio and invest into products that are decorrelated from interest rates and from the major stock market indexes.

This situation creates an opportunity for investors to finance commodity traders and the market has seen the emergence of trade finance funds. Because of the increasing demand, this 2nd tier trade finance market is growing and there is room for new trade finance funds.

To address this well identified opportunity, Bluestone Asset Manager Ltd (an independent fund manager based in Mauritius, “the Asset Manager”) has decided to form a new fund dedicated to providing financing to international trading houses: The Bluestone Merchant Fund Ltd.

To guarantee the success of this new investment vehicle, Bluestone Asset Manager Ltd has appointed MFT Services SA, as the Investment Advisor for its fund.

MFT Services SA is a Geneva based consultancy firm with a long-term presence in the trade finance world. It has been built on the 25 year+ success of Mr. Maurice Taylor as an independent international trade consultant.

The FUND

Bluestone Merchant Fund Ltd (“the Fund”) is a public company, limited by shares and incorporated under the laws of Mauritius.

The Fund holds a Global Business License issued by the Mauritius Financial Services Commission and has been authorized as a collective investment scheme with multi-class share capital structure classified as an Expert Fund under the Securities Act 2005 and the Regulations.

Bluestone Merchant Fund Ltd aims at offering to small to mid-sized trading companies an alternative to banks in financing all or part of a deal and to investors stable, uncorrelated and an above market rate of return.

Bluestone Merchant Fund Ltd’s major features are:

- to have no geographical restrictions (except the sanctioned countries)

- to consider a vast range of type of goods, including products traditionally not financed by banks (food, pharmaceutical products, used cooking oil, etc.)

- aimed at financing small and medium sized trading companies (although, in certain circumstances, the Fund will also finance larger traders for specific operations).

The Fund’s investment objective is to achieve capital appreciation of about 9 % p.a. in USD from various type of debt instruments secured by the pledge over the goods and/or the assignment of receivables, and issued by, related to, trading companies which trade commodities, pharmaceutical products and/or food products.

Bluestone Merchant Fund Ltd offers monthly liquidity with 4 months redemption notice and has shares in USD.

THE INVESTMENT POLICY

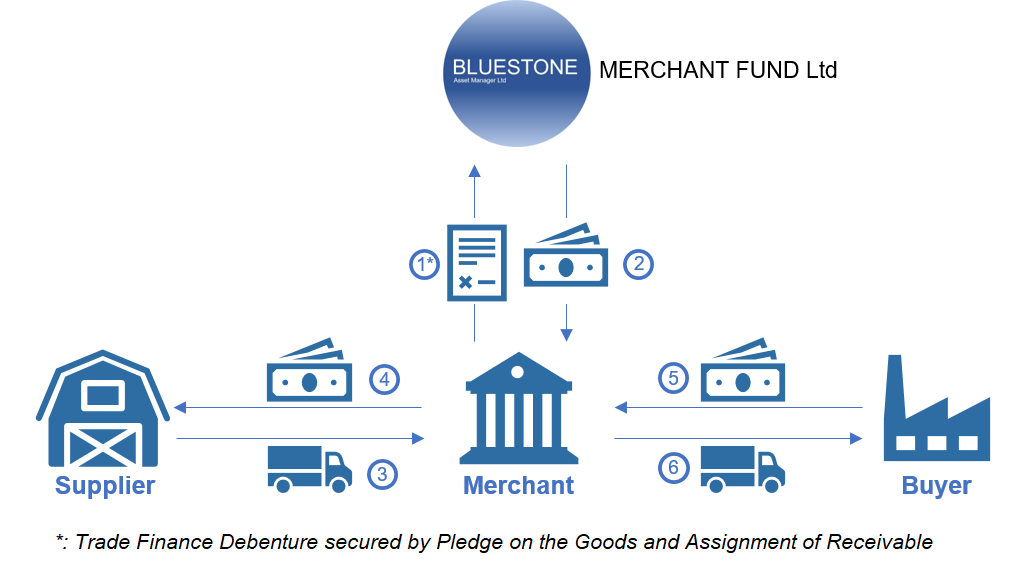

The borrowers are trading houses which buy, store and/or transport commodities and resell the same goods.

Because of tightening regulation and the risk aversion of trade financing banks, commodity traders are currently essentially onshore companies, many of which are established in Switzerland.

The lenders: historically, international trade has mainly been financed by international banks. Today, banks are concentrating on large sized trading companies leaving small to mid-sized viable businesses in search for financing.

Among other funding sources, the Bluestone Merchant Fund Ltd is a regulated structure that unites investors (“the lenders”) and lends, with a margin, money to trading entities on a trade by trade basis.

The goods financed are commodities, food and pharmaceutical products or raw materials for which there is a large market.

Transactional approach: to finance a deal, Bluestone Merchant Fund Ltd analyses the financials of the borrower and pays a great deal of attention to the transaction itself, in particular at how the borrower buys the goods, how the goods are stored, transported and how the goods are sold.

If the deal is financed by the Fund, Bluestone Merchant Fund Ltd receives a legal pledge over the financed goods as well as an assignment of the receivable

As the financed goods are traded in a vast and liquid market, the Fund limits its risk because, in the unlikely case of the borrower’s default, the Fund can execute the pledge and sell the financed goods in order to be repaid.

THE INVESTMENT OBJECTIVE

Bluestone Merchant Fund Ltd is a Mauritius based open-ended fund whose objective is to achieve capital appreciation of about 9 % p.a. in USD from various types of debt instruments secured by the pledge over the goods and/or the assignment of receivables and other instruments issued by and related to trading companies which trade commodities, pharmaceutical products and/or food products.

Because of its investments diversified across multiple products, Bluestone Merchant Fund Ltd offers above market uncorrelated returns associated with low volatility.

THE INVESTMENT ADVISOR

For deal sourcing, the Investment Manager shall use the services of MFT Services SA (“the Investment Advisor”), a Geneva based consultancy firm and a member of ARIF, a Swiss auto-regulated body supervised by FINMA, the Swiss Financial authorities, with a well established presence in the world of trade finance.

MFT Services SA was incorporated in 2013 to build on Maurice Taylor’s success as an independent trade consultant and whose professional activity was established in Geneva in 1993, encompassing a full range of high quality services to international customers and specialized commercial banks alike, in the area of commodity trading, trade finance and several other related activities.

MFT Services SA is based in Geneva, Switzerland, close to all major commercial and private banks and law firms, tax advisors and other key service providers

MFT Services SA employs a growing team of fourteen professionals with various nationalities, backgrounds and experience, twelve of them having an extensive background in the field of trade finance. The senior staff members have held senior positions in renowned actors in the trade finance activity in Geneva and Lausanne (i.e. international trading companies, trade finance banks, inspection companies, merchant funds) and have a long standing experience in dealing with complex matters involving sophisticated customers.

The Investment Advisor has extensive expertise in financial services and trade financing deals.

The Investment Advisor’s team shall actively source deals in line with the Fund’s objectives.

The Fund’s details

Currency | USD |

|---|---|

Liquidity in | Monthly |

Liquidity out | Monthly (with a 4 month notice) |

Expected return for the USD share class | Around 9 % p.a. |

| Expected return for the EUR share class | Around 8 % p.a. |

Expected volatility | Around 0.5% p.a. |

Minimal Investment | USD 100’000.- |

ISIN Number for the USD share class | MU0674S00004 |

| ISIN Number for the EUR share class | MU0674S00012 |

| Bloomberg Ticker | BLMRFUA |

Contacts details

THE FUND

Bluestone Merchant Fund Ltd

6th Floor, THE CORE, 62 ICT Avenue, Cybercity Ebene

Republic of Mauritius

www.bluestone-am.com

THE FUND MANAGER

Bluestone Asset Manager Ltd

6th Floor, THE CORE, 62 ICT Avenue, Cybercity Ebene

Republic of Mauritius

www.bluestone-am.com

INVESTMENT ADVISOR

MFT Services SA

Rue du Marché 18

CH-1204 Geneva

Switzerland

www.mftservices.ch

CENTRAL ADMINISTRATOR

Finsburey Management Services Ltd

6th Floor, THE CORE, 62 ICT Avenue, Cybercity Ebene

Republic of Mauritius

www.finsburey.com

Custodian Bank 1

The Mauritius Commercial Bank Ltd

9-15 Sir Wiliam Newton Street,

Port Louis

Republic of Mauritius

www.mcb.mu

SWIFT Code: MCBLMUMU

Custodian Bank 2

SBM Bank (Mauritius) Limited

6th Floor SBM Tower

Port Louis

Republic of Mauritius

www.sbmgroup.mu

SWIFT Code: STCBMUMU

Auditor

Nexia Baker & Arenson

5th floor C&R Court, 49

Labourdonnais St,

Port Louis,

Republic of Mauritius

www.nexia.mu

Bluestone Merchant Fund Ltd ("Fund") is a public company, limited by shares incorporated under the laws of Mauritius The Fund holds a Global Business License issued by the Mauritius Financial Services Commission and has been authorized as a collective investment scheme with multi class share capital structure classified as an Expert Fund under the Securities Act 2005 and the Regulations The Fund’s investment objective is to achieve capital appreciation of about 7 p a from various type of debt instruments secured by the pledge on the goods and/or the assignment of receivables, and issued by, related to, trading companies which trade commodities, pharmaceutical products and/or food products

The Investment Manager shall use the services of MFT Services SA (“Investment Advisor”), a Geneva based consultancy firm and a member of ARIF with a well established presence in the world of Trade Finance, for deal sourcing. The Investment Advisor has extensive expertise in the financial services and trade financing deals. The advisory team shall actively source deals in line with the Fund’s objectives.